Women And Retirement

Women face a complex set of challenges when preparing for retirement.

Due to structural inequalities in working life, women are entering retirement with far fewer assets than men. Women also live longer, meaning that they need more savings than men to have a comparable income and face higher long-term care costs in retirement. In this section we look at each of these issues in more detail.

LESS SAVINGS

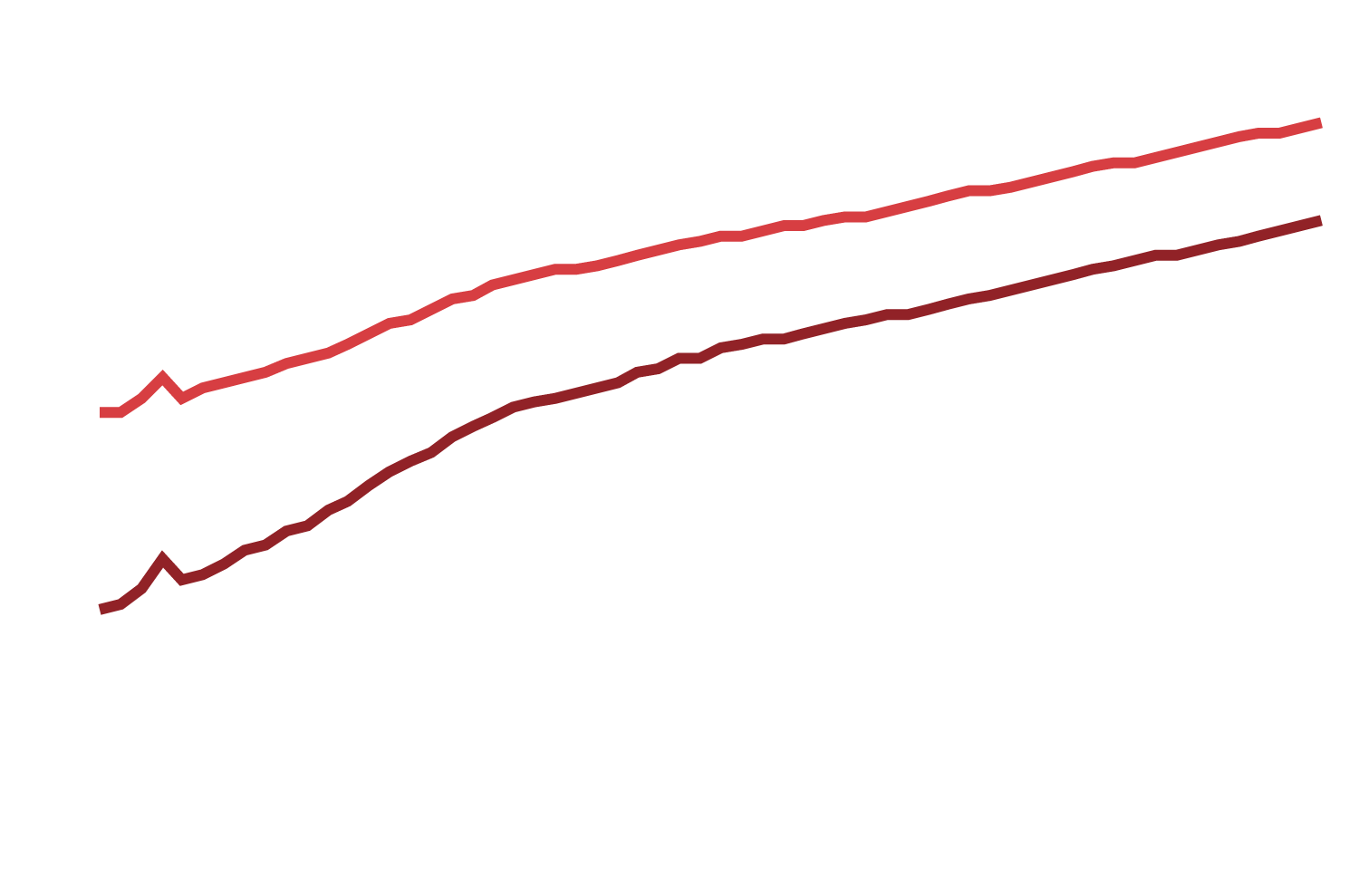

ON AVERAGE, WOMEN SAVE SIGNIFICANTLY LESS THROUGHOUT THEIR LIFETIMES AS MEN

Among those who save, men were saving close to 16% of their income, while women were only saving 13.5%, and the growth in women’s savings rates appears to have plateaued. Lower savings rates, along with higher prevalence of part-time work and career breaks may mean that the average woman may amass £100,000 less retirement savings than her male counterpart.

Conclusion

Women and Retirement

Women are on average entering retirement with far fewer assets than men. In retirement, longer lives and greater care needs places additional pressure on women's more limited resources.

In our Women and Retirement report you can read more about these challenges, what this might look like for younger women entering the workforce and policy reforms to bridge the gender gap.

You can also explore 17 years’ worth of Scottish Widows Retirement Report data through our interactive hub. For those who want to delve a bit deeper into our findings over the years, you can use this tool to create your own reports.